American Staffing, Inc. Case Study

This case study shows how Accounts Receivable Financing can be used to solve the cash flow issues of a staffing company, highlighting the receivable financing problems and solutions process. To protect client privacy, we have changed some details (including their name) in this business case. Also, the numbers have been simplified to make the case study easy to understand, but the key facts and lessons remain.

The Challenge

American Staffing, Inc. (ASI) is a staffing company that matches large corporate clients with qualified candidates to fill open positions within the corporation. Although ASI is a small company with just a few employees, they have secured three large contracts. However, between start-up costs, payroll, and operating expenses, the company only has $10,000 left in the bank.

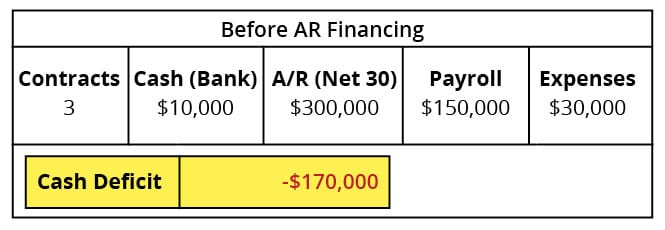

Their three contracts each pay $100,000 per month for services, but the invoices are paid 30 days after services have been delivered. The company’s payroll is $150,000 per month and an additional $30,000 dollars per month is spent on other general business expenses. The table below provides a simplified snapshot of ASI’s financial position:

Although the company is doing relatively well, it is low on cash and won’t be able to meet their general expense and payroll liabilities, causing them to have a cash deficit of $170,000. ASI will have money coming in as soon as their invoices are paid, but in the meantime, they are unable to meet their expenses.

Solving the Problem with AR Financing

ASI could solve their current cash flow issue with a business loan, but there is a problem with this approach. Banks don’t usually provide financing to small companies unless they have substantial collateral and a track record of profits, ASI has neither. Also, getting bank financing can often take a while. This won’t help a company that needs funds quickly.

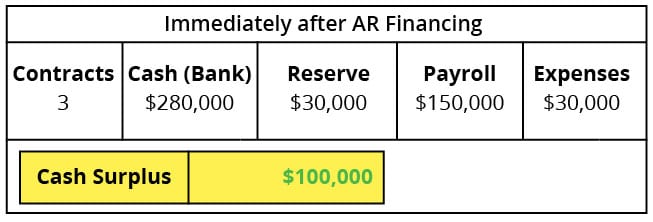

AR Finance can solve the problem by financing slow-paying invoices from credit-worthy commercial clients. This solution allows ASI to turn a portion of their slow-paying receivables into immediate cash, usually up to 90% of outstanding invoices is advanced to the client. The remaining 10% is held as a reserve until the invoices are paid in full. At that time, the transaction settles.

The following table shows a summary snapshot of ASI’s financial position after Accounts Receivable Financing has been deployed.

The first thing to notice is that the cash deficit turned into a cash surplus of $100,000. The $30,000 held as reserve will be returned, less the finance fee, once ASI’s customers pay the invoices. The company now has enough cash to pay its operating expenses and payroll.

The Biggest Benefit – Growth

The biggest benefit from this transaction is not immediately obvious from the post-AR Financing snapshot. ASI previously had been unable to take on new clients, even though demand for their services were high. They simply could not afford to offer commercial credit terms to their new clients, mainly because it would require an increase in employees and associated general expenses. Unfortunately, growth was not an option, and even survival was questionable.

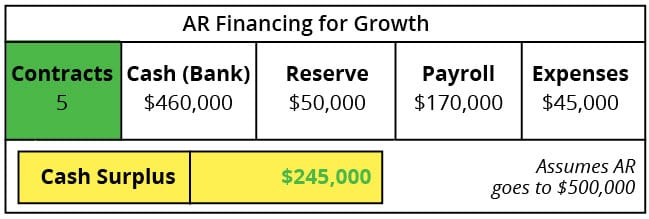

However, Accounts Receivable Financing changed their circumstances. After implementing the financing facility, they were able to take on two new clients, which increased A/R by $200,000. ASI was able to easily pay for the increase in payroll and other expenses thanks to their AR financing line. The following table shows a summary snapshot of ASI’s growth financial position.

Why did AR Financing work so well for ASI?

ASI was able to achieve a financial turnaround relatively quickly using Accounts Receivable Financing. The company had a number of things going for it which helped this happen.

First, the company was well run and very profitable from the start. As is shown clearly in the second table, they had a sizable cash surplus after the first financing transaction. In fact, if they had chosen to stay at their current size, they could have stopped using AR Financing soon after building an adequate reserve – a process that would have taken less than a year.

ASI also worked with three large corporate clients, all well-known, brand-name companies who had great commercial credit. This simplified the process of financing their invoices because the collateral was excellent.

Above all, ASI’s management was smart. They were able to leverage their AR Financing line into a growth tool that allowed them to take on new clients. It wasn’t long before they were only financing invoices from new clients, as they no longer needed funding for their initial three clients. Basically, AR Financing allowed them to finance their growth.

Transitioning to the Bank

The one challenge for ASI was that the cost of Accounts Receivable Financing was higher than the cost of more traditional financing options, like a business loan. This was not an issue when they had a cash flow emergency and AR Financing was their only option. However, management was smart and used their receivables financing line as a stepping stone to traditional financing. Within two years, ASI was able to meet the underwriting requirements of a bank and secured a sizable line of credit. They used the line of credit to replace the AR financing line, which further increased their profitability.