Category: Small Business

Keep your Company’s Cash Flowing through a Seasonal Slump

Read MoreKeep your Company’s Cash Flowing through a Seasonal Slump

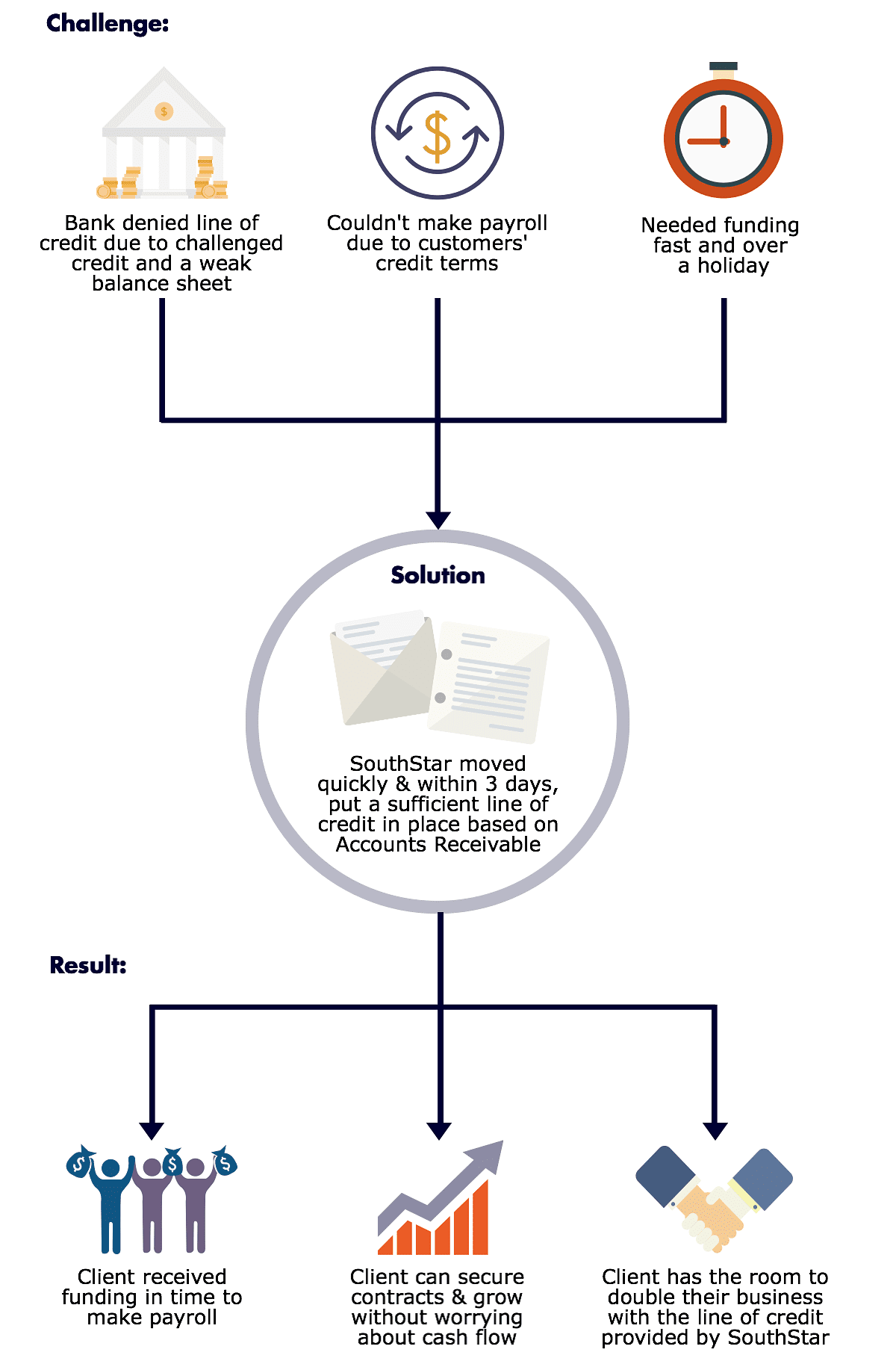

SouthStar’s Preferred Broker Program

CLICK HERE to learn more about SouthStar Capital’s Preferred Broker Program! You can also contact us by email at brokers@southstarcapital.com or by calling 888-842-3777.

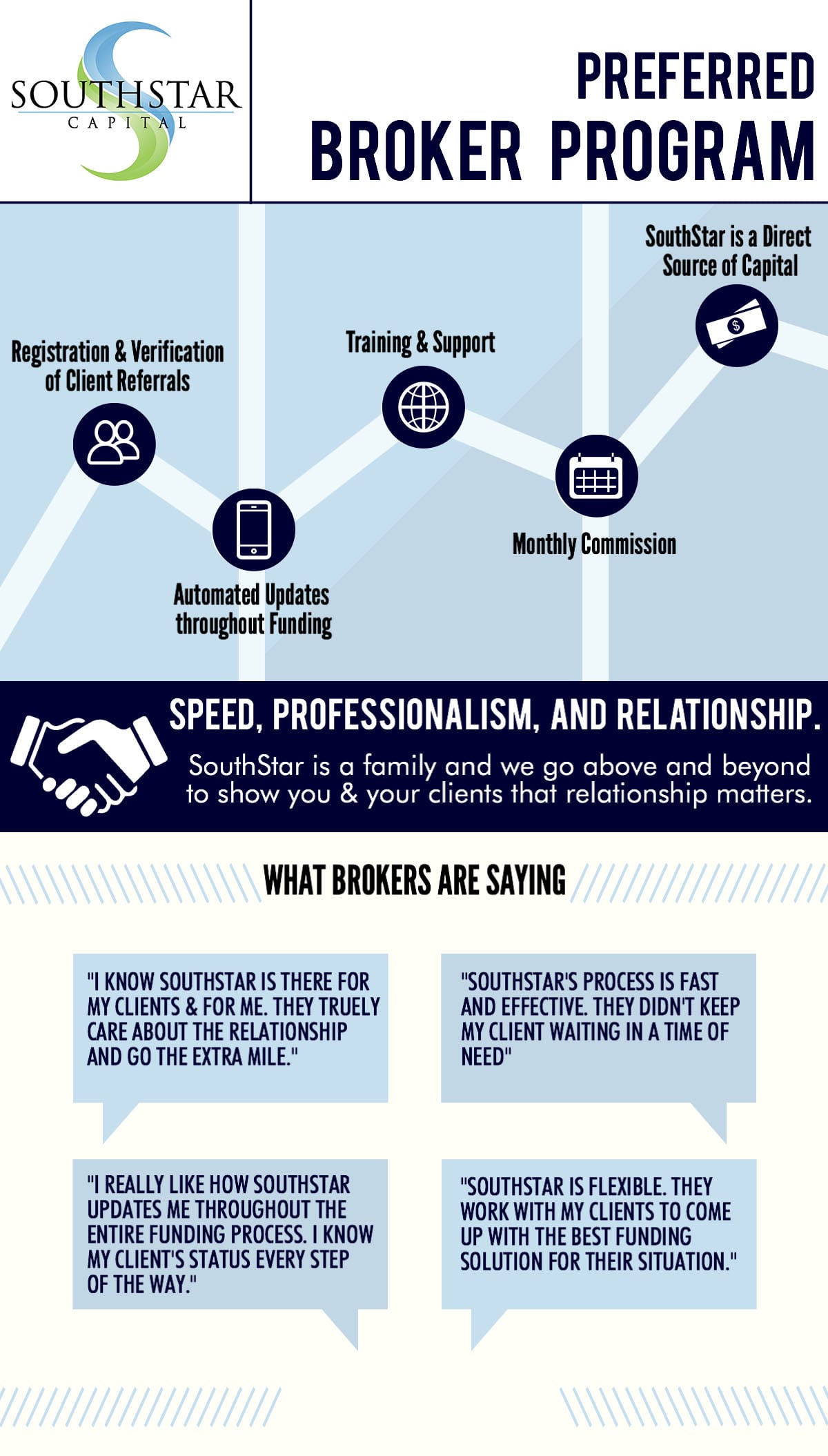

Understanding Accounts Receivable Financing

CLICK HERE to learn more about Accounts Receivable Financing with SouthStar Capital!

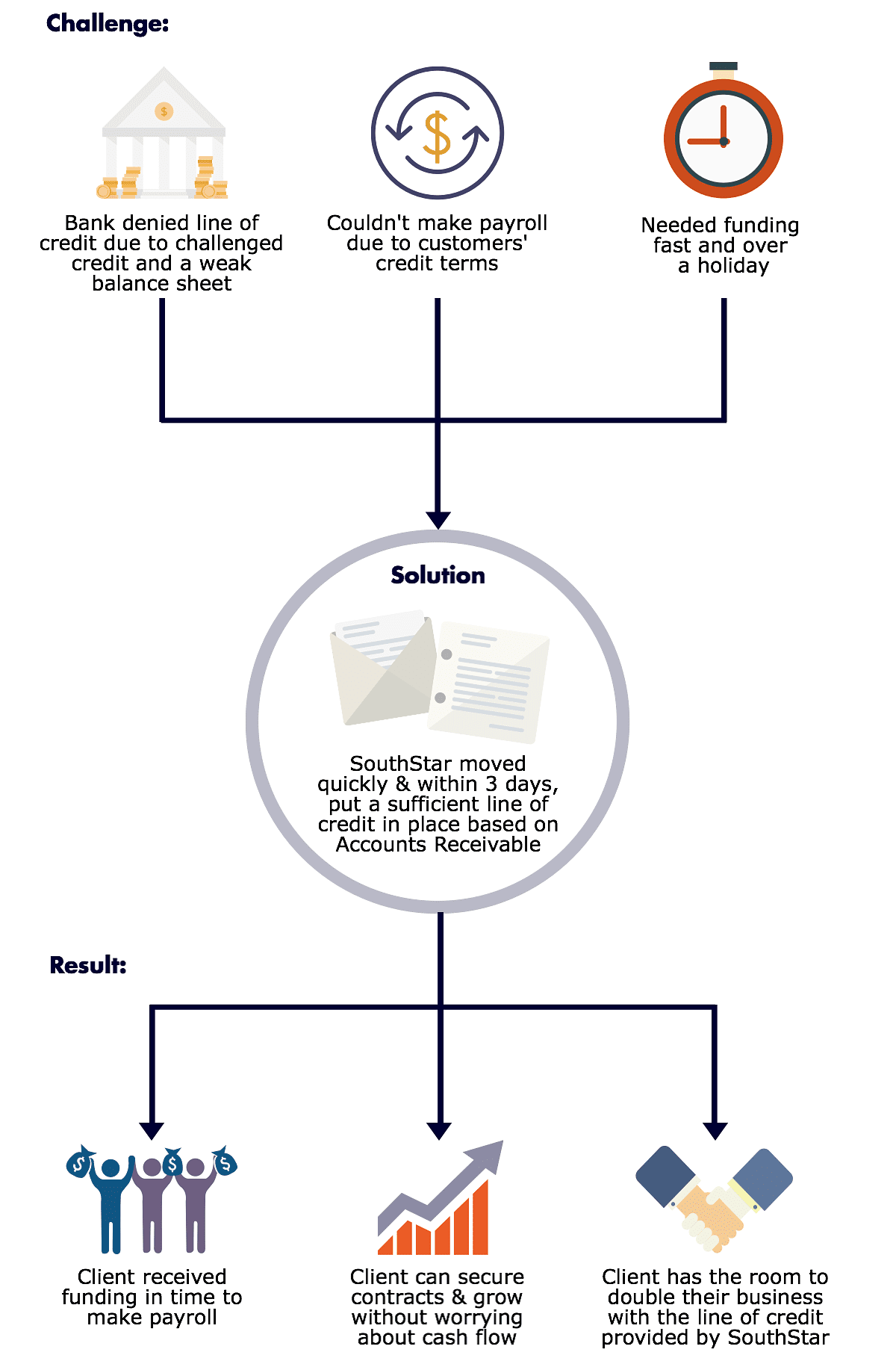

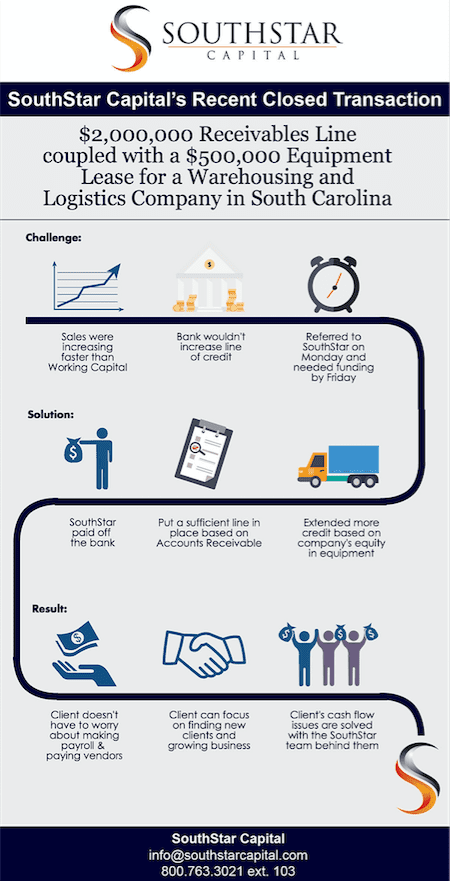

SouthStar’s Recent Closed Transaction

We can tailor fit a solution to meet your company’s needs!

Pentagon Now Pushing For More Frequent Interaction With Private Sector

Over the last few years the private sector has been wondering where the DOD has been. Due to budget cuts and travel expenditures being turned down, the Government has taken a back seat to the rest of the world in bringing on new tech. This has left many asking, where are the procurement officers and why new technology is sitting around collecting dust? That is all about to change. Deputy Defense Secretary Robert Work and Undersecretary Frank Kendall are asking all branches of the military and defense agencies to more actively participate in industry conferences as part of a broad

Read MorePentagon Now Pushing For More Frequent Interaction With Private Sector

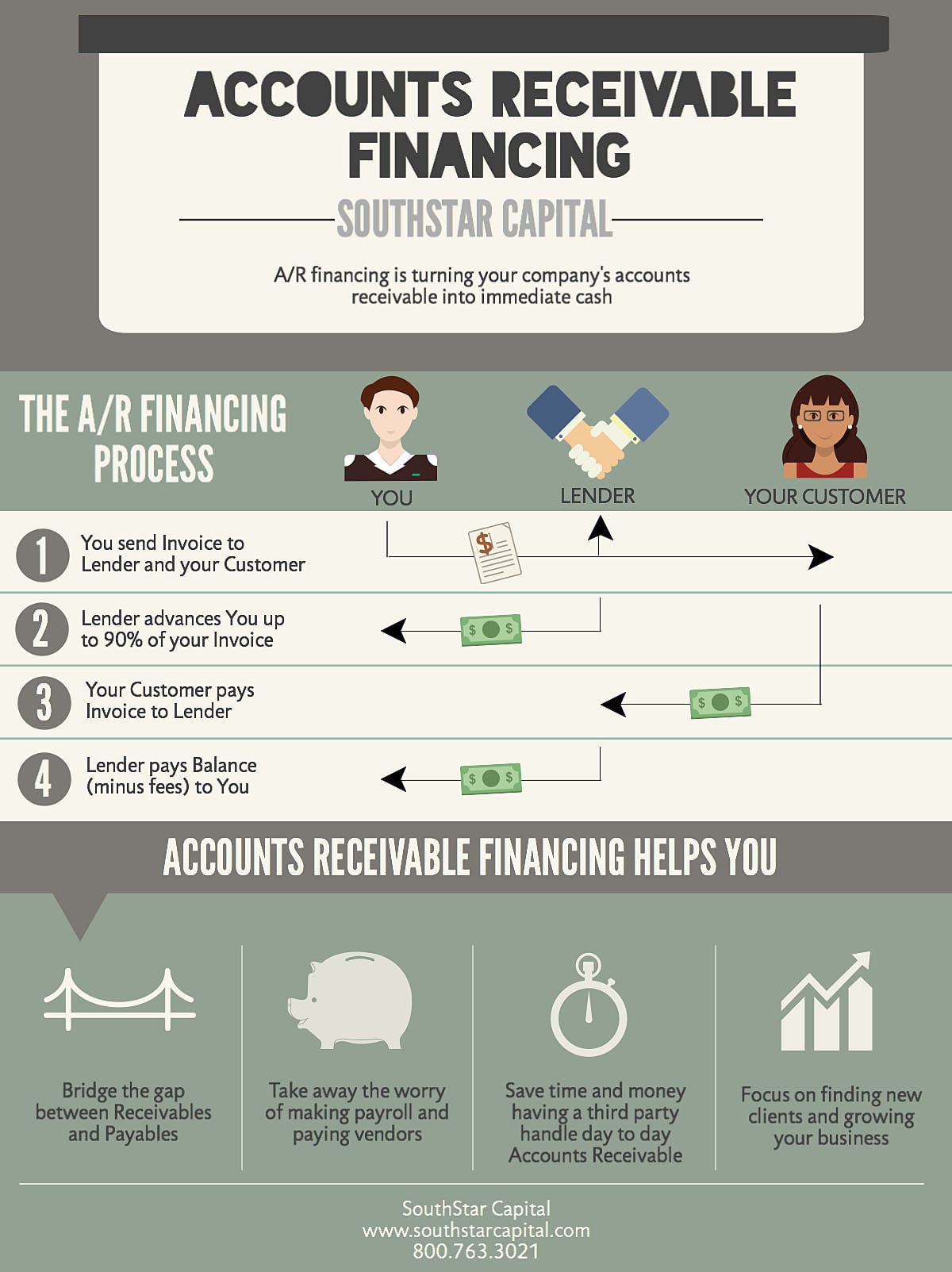

Recent Closing From SouthStar

SouthStar is excited to announce a recently closed transaction $1,000,000 Receivables Line Coupled With a $500,000 Purchase Order Line Fuels Growth for a Manufacturing Company in Florida Challenge The Manufacturing Company recently brought an exciting new product line to market which resulted in sales increasing by 100% month over month over month! In order to keep up with demand the Client utilized what cash they had in the bank to buy more equipment to keep up. While this was great it left them with little to no money to pay suppliers which left them with great potential and many orders

Interesting Business Development trends from post-crisis regulation in B2B finance.

As capital requirements increase, the cost of capital and liquidity increase. This puts strong pressure on bank margins. When that happens some business development trends emerge and many small businesses are left out in the cold to fend for themselves. This leads business owners to Merchant cash advances, and loan sharks. In order to prevent that you need to see and know your options. Trend #1: More fees please. Mid-sized and large companies are getting beat to death with derivatives and other capital markets solutions and all businesses are getting flooded with the treasury management sale. It’s not really less

Read MoreInteresting Business Development trends from post-crisis regulation in B2B finance.

New Job Posting for SouthStar

We continue to grow at SouthStar and we are seeking positive, intelligent and hardworking individual to join our team. See below for more details. Client Relationship Specialist I SouthStar Capital LLC, an Asset Based Lending Group in the Southeastern commercial finance market, is now expanding and seeking a Client Relationship Specialist I for our office in Charleston, South Carolina. We are a privately funded company specializing in providing working capital lines of credit to growing businesses from 100K to 5MM Monthly. Our Office environment is a fun workplace, with a business casual environment often eating lunch, socializing and enjoying what

Young Companies and Working Capital

An often overlooked issue confronting young companies is that of having sufficient working capital. The entrepreneurs who start up these companies pour their hearts, souls, and often, life savings into getting the enterprise off the ground. They are successful at finding just the right product or service to fit a need and the business begins to take off. Growth, however, is not always self-sustaining. Many times orders will overrun the capital needed to fulfill them. In these scenarios, the entrepreneur has to make some serious financial decisions that will affect the long term success of the company and the value