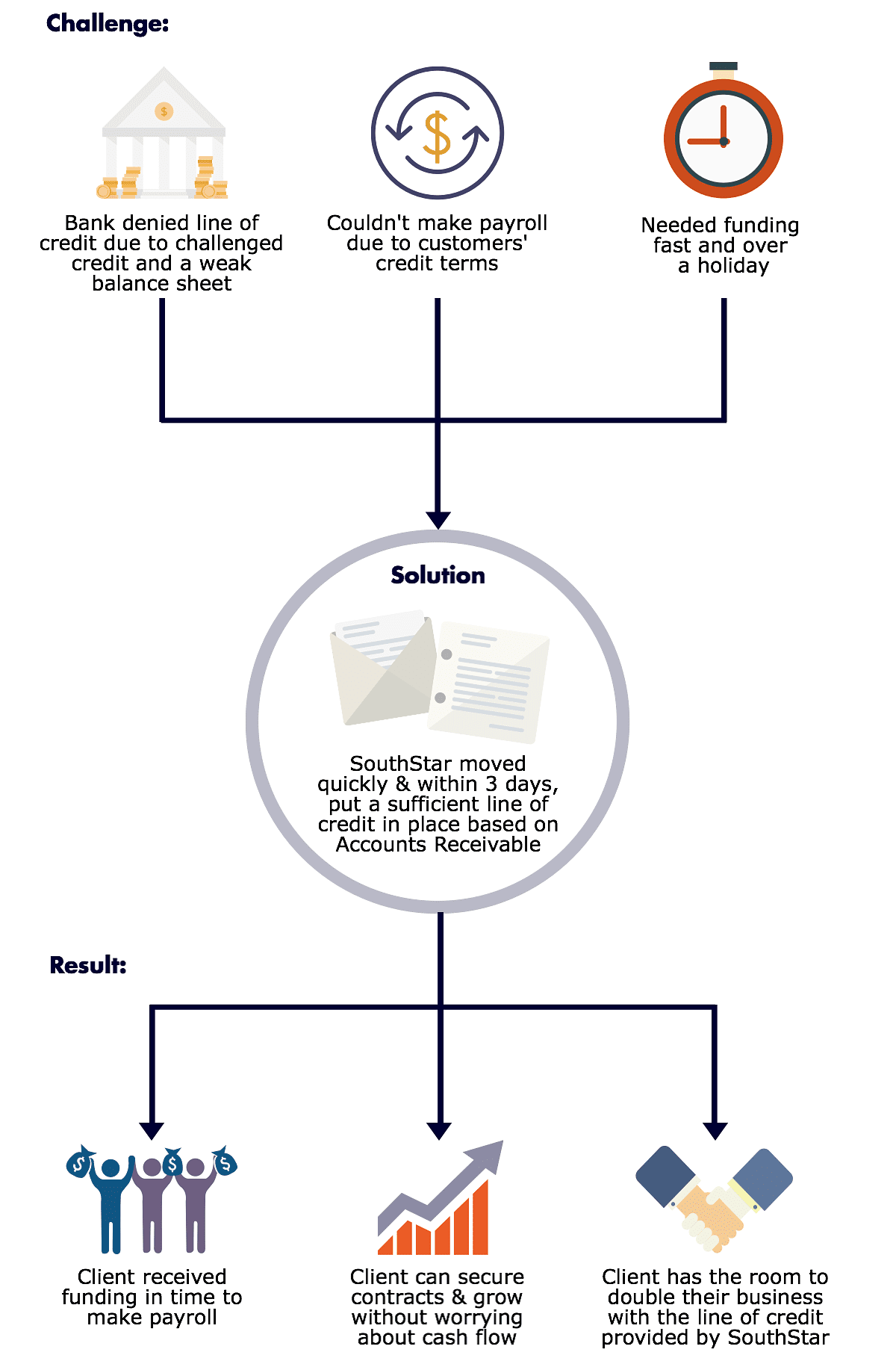

Read MoreYour Business needs Cash Flow, but You have Poor Credit…Now What?

Read MoreYour Business needs Cash Flow, but You have Poor Credit…Now What?

CLICK HERE to learn more about Accounts Receivable Financing with SouthStar Capital!

We can tailor fit a solution to meet your company’s needs!

Read More10 ways to build strong referral relationships between you and SouthStar Capital

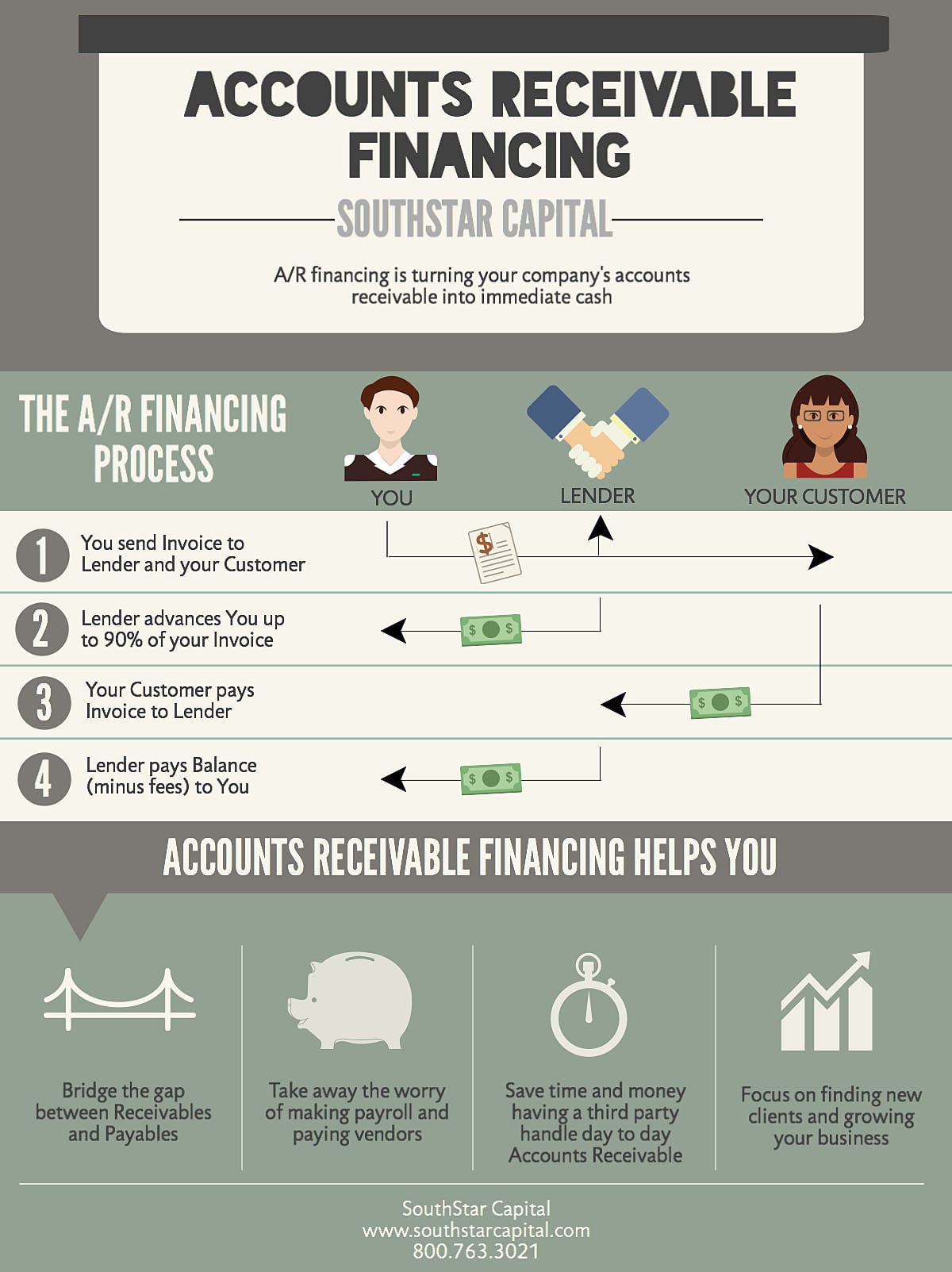

With the tightening of business credit, companies are struggling to make ends meet amid a backdrop of uncertainty. Companies are taking longer to pay invoices and the effects are reverberating throughout the global economy. Banks raise interest rates and businesses are left to deal with the consequences. However, there are credit alternatives that allow companies to assume a more hands-on approach to financing their business. They include asset-based lending practices and the most common ABL financing vehicles are purchase order financing, and accounts receivables factoring. Both options empower businesses to take charge of their capital requirements and are a much

Cash flow has always been a concern for businesses. Unfortunately, there just doesn’t seem to be a solution, or is there? Well, there is one remedy companies can call upon. It’s a practice that has become extremely popular amongst those businesses looking to take charge of their finances. What is it you ask? It is accounts receivable financing and it’s easily the most impactful form of business financing available today. Simply put, receivable financing provides companies with immediate access to working capital. Companies can then use this capital to lower their costs by negotiating prompt payment discounts from vendors, use

In order to succeed in business you must have access to affordable credit. This requires a financing solution that empowers companies to be more proactive instead of reactive. Accounts receivable financing is one powerful financing solution that puts the power of business financing in the hands of companies and business owners. Given its popularity amongst today’s businesses, what can companies unfamiliar with this financing option expect? More importantly, what is accounts receivable financing, and why do a number of companies consider it to be their financing method of choice? Accounts receivable factoring works because it allows companies to use the

Read MoreAccounts Receivable Financing & Factoring Companies

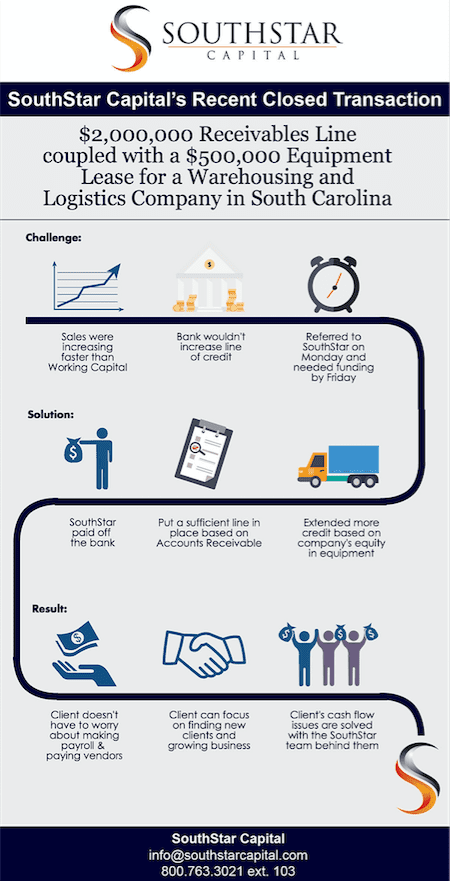

Looking for alternative business financing solutions but unsure of where to look? Not convinced there are other options worth pursuing? Granted, banks and credit unions have been the more conventional lenders of businesses but there are other options and it’s imperative that companies be well versed in these alternatives. So what are these other options? They are accounts receivable factoring and purchase order financing and both provide companies with the means to take charge of their business financing needs in ways most conventional lending sources can’t. In fact, both have quickly established themselves as the preferred method of business financing

Risks of financial investment vary depending on the line of business one enters into. Perhaps, small business venture is the easiest and simplest thread to penetrate because control and operation concern management of clear-cut transactions, small work force, and moderate inventory. Aside from private operation, many would prefer undertaking small business because red tape rigidity, which beefs up the difficulty to secure bureaucratic approval, may be averted unlike large business. Small business is usually a misnomer. It does not only embrace sole proprietorship but also corporations and partnerships owned privately. Apparently, the amount of capitalization and line of business determine